Structure Confidence: Dependable Trust Foundations

Structure Confidence: Dependable Trust Foundations

Blog Article

Guarding Your Assets: Trust Structure Knowledge within your reaches

In today's complex financial landscape, making sure the security and growth of your properties is extremely important. Trust structures serve as a cornerstone for securing your riches and heritage, providing an organized strategy to property protection.

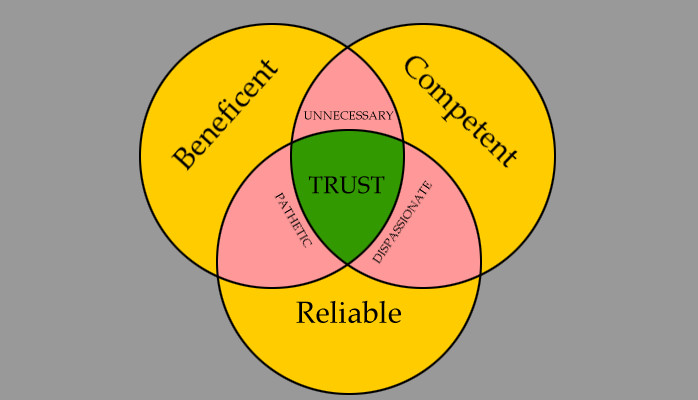

Importance of Count On Foundations

Count on structures play a critical role in establishing reliability and cultivating solid relationships in different specialist setups. Building trust fund is crucial for services to flourish, as it forms the basis of effective cooperations and collaborations. When count on is existing, individuals feel more certain in their communications, resulting in raised performance and performance. Trust fund structures serve as the keystone for ethical decision-making and clear interaction within organizations. By focusing on count on, services can develop a favorable job culture where employees really feel valued and respected.

Benefits of Specialist Assistance

Structure on the foundation of rely on specialist partnerships, looking for expert guidance uses vital benefits for people and companies alike. Expert advice gives a riches of expertise and experience that can assist navigate complicated economic, lawful, or critical challenges effortlessly. By leveraging the expertise of professionals in various areas, people and organizations can make educated choices that line up with their objectives and ambitions.

One considerable advantage of expert advice is the capacity to gain access to specialized knowledge that might not be easily available otherwise. Experts can supply understandings and perspectives that can result in cutting-edge solutions and chances for development. In addition, functioning with experts can help minimize dangers and unpredictabilities by providing a clear roadmap for success.

In addition, specialist guidance can save time and sources by streamlining procedures and avoiding expensive blunders. trust foundations. Professionals can offer personalized suggestions customized to certain requirements, guaranteeing that every decision is well-informed and tactical. In general, the benefits of professional assistance are multifaceted, making it a useful property in securing and maximizing assets for the lengthy term

Ensuring Financial Protection

In the realm of economic preparation, securing a stable and thriving future rest on calculated decision-making and sensible financial investment selections. Ensuring financial safety and security involves a diverse method that includes different facets of riches management. One essential aspect is creating a diversified investment profile customized to private danger tolerance and monetary goals. By spreading out investments across various asset courses, such as stocks, bonds, real estate, and commodities, the risk of significant financial loss can be minimized.

Furthermore, keeping a reserve is important to secure versus unexpected expenditures or income disturbances. Professionals advise alloting three to six months' well worth of living costs in a fluid, quickly accessible account. This fund functions as a monetary security web, supplying peace of mind during rough times.

Consistently reviewing and changing monetary plans in response to changing conditions is additionally paramount. Life events, market fluctuations, and legal adjustments can impact financial stability, underscoring here are the findings the importance of ongoing evaluation and adaptation in the search of long-term monetary protection - trust foundations. By executing these methods thoughtfully and regularly, people can fortify their financial ground and job in the direction of a much more safe and secure future

Safeguarding Your Assets Efficiently

With a strong structure in area for monetary safety and security with diversity and reserve maintenance, the following critical step is protecting your properties efficiently. Guarding possessions involves securing your riches from prospective threats such as market volatility, financial recessions, suits, and unexpected expenditures. One reliable method is property appropriation, which involves spreading your investments across numerous asset courses to minimize threat. Diversifying your portfolio can help mitigate losses in one area by balancing it with gains in one more.

Furthermore, developing a trust can provide a safe method to safeguard your properties for future generations. Counts on can aid you regulate just how your assets are distributed, decrease inheritance tax, and shield your riches from financial institutions. By applying these approaches and looking for expert suggestions, you can protect your possessions properly and secure your monetary future.

Long-Term Property Protection

Long-lasting asset security entails implementing steps to safeguard your assets from different dangers such as economic recessions, lawsuits, or unexpected life events. One important facet of long-term asset security is developing a trust, which can provide substantial advantages in securing your assets from financial institutions and lawful conflicts.

In addition, diversifying your investment portfolio is an additional key approach for lasting possession defense. By taking a positive method to lasting property defense, you can protect your discover this riches and supply economic protection for on your own and future generations.

Final Thought

Finally, count on structures play a crucial function in safeguarding properties and making sure monetary security. Professional advice in establishing and handling count on frameworks is crucial for long-term property security. By utilizing the know-how of specialists in this field, individuals can efficiently secure their possessions and prepare for the future Continue with confidence. Trust fund structures provide a strong structure for securing wealth and passing it on future generations.

Report this page